Jun 8, 2023

30 minutes

Hello and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines. This is our Wednesday (Thursday, this week) show where we niche down to a single topic and dig deep.

The Cool Kids are Talking

All the cool kids are filling out the Equity listener survey. We want to hear from you!

Interview with Henry Ward, CEO of Carta

This week, Alex brought on Carta CEO Henry Ward to chat through the early-stage market with us. We had a grip of data and a sheaf of questions, which were augmented at the last minute with a data dump from Carta itself.

The Current State of the Early-Stage Venture Capital Market

From Ward’s perspective, the early-stage market is in better shape than many folks think; it’s the later stages of venture capital that are torpid. We also riffed on the quality of startups that are raising today, and how much pain is coming for young tech companies that can’t quite attract more capital.

Early-Stage Market: Better Than You Think

- The early-stage market is a vital component of the startup ecosystem.

- It’s where new ideas are born, and innovative solutions are developed.

- Despite challenges, the early-stage market remains robust, with many startups successfully raising funds.

- However, later stages of venture capital have slowed down, indicating potential bottlenecks in the system.

Carta’s New Seed and Series A Product

Carta recently announced a mostly automated method for closing early-stage rounds. We wanted to better understand the economics of the effort — and why it’s more expensive to raise today than it was a few years back — and what the unicorn hopes to achieve from the work.

The Economics of Early-Stage Rounds

- Raising capital is becoming increasingly challenging for startups.

- Early-stage rounds are typically more expensive than they were in the past.

- Carta’s new product aims to streamline the process, reducing costs and increasing efficiency.

- By automating early-stage rounds, Carta hopes to create a more sustainable and scalable model.

A Look Ahead: The Future of Early-Stage Venture Capital

We ended with a look ahead, and a series of fun closing questions with Ward. That’s just the high-level summary. We also discussed entrepreneurship more broadly, the importance of LLCs, and even how to construct a podcast interview. It was good fun!

Entrepreneurship 101: A Quick Primer

- Entrepreneurship is about turning ideas into reality.

- Starting a business requires hard work, dedication, and a willingness to take risks.

- LLCs offer flexibility and protection for entrepreneurs.

- Podcast interviews are an effective way to share knowledge and insights with a wider audience.

The Future of Early-Stage Venture Capital

As we wrap up this episode, it’s clear that the early-stage venture capital market is at a critical juncture. With Carta leading the charge, there may be new opportunities for innovation and growth. However, challenges persist, and startups must adapt to changing market conditions.

Conclusion

The future of early-stage venture capital is uncertain, but one thing is clear: change is coming. As we navigate this evolving landscape, it’s essential to stay informed, adaptable, and committed to our core values.

Subscribe to us on Apple Podcasts, Overcast, Spotify, and all the casts. TechCrunch also has a great show on crypto, ashow that interviews founders, one that details how our stories come together, and more!

Episode Transcripts and More at Simplecast

For episode transcripts and more, head to Equity’s Simplecast website.

Alex Wilhelm was a senior reporter for TechCrunch covering the markets, venture capital, and startups. He was also the founding host of TechCrunch’s Webby Award-winning podcast Equity.

Stay Informed with Our News Roundup

We are back Friday with our news roundup. Talk soon!

- Apple may add an iPhone Air to its lineup

- Researchers open source Sky-T1, a ‘reasoning’ AI model that can be trained for less than $450

- I got soaked driving the Arc Sport electric boat

- Matt Mullenweg deactivates WordPress contributor accounts over alleged fork plans

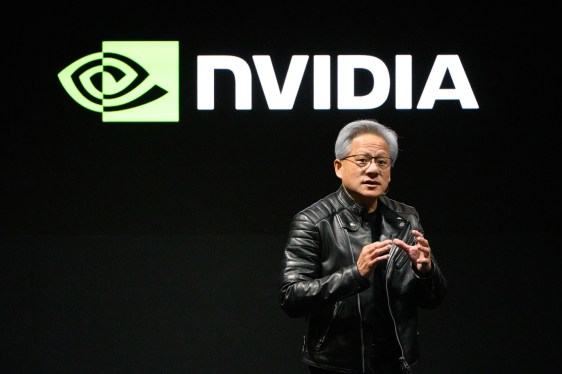

- Nvidia’s AI empire: A look at its top startup investments

Latest Equity Episodes

- Startups: $5B livestream shopping apps, Nvidia reveals, and the weirdest tech at CES

- 2024: Founder mode, AI, and the ‘Rise of the Broligarchs’

- Fundraising: Are AI companies just defense tech now?

- Building physical tech is back in fashion thanks to AI, robotics, and defense

Get in Touch with Us

We’d love to hear from you! Filling out the Equity listener survey will help us better understand your needs and preferences.